www tax ny gov enhanced star

The STAR program can save homeowners hundreds of dollars each year. Enter the security code displayed below and then select Continue.

Nys Changes Are Causing Confusion With The Star School Tax Relief Program

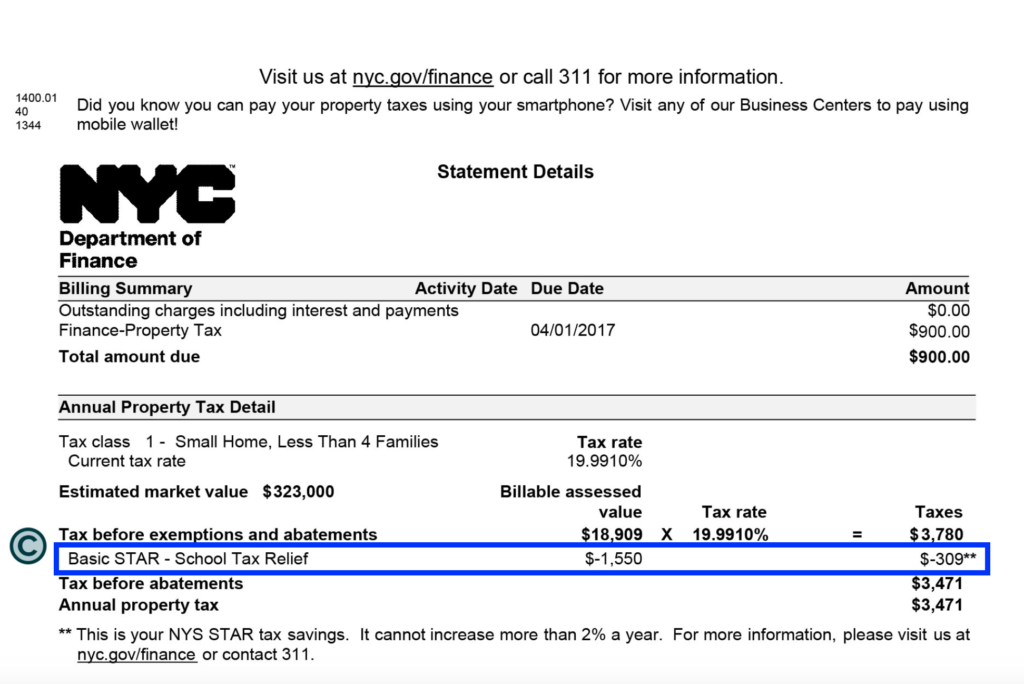

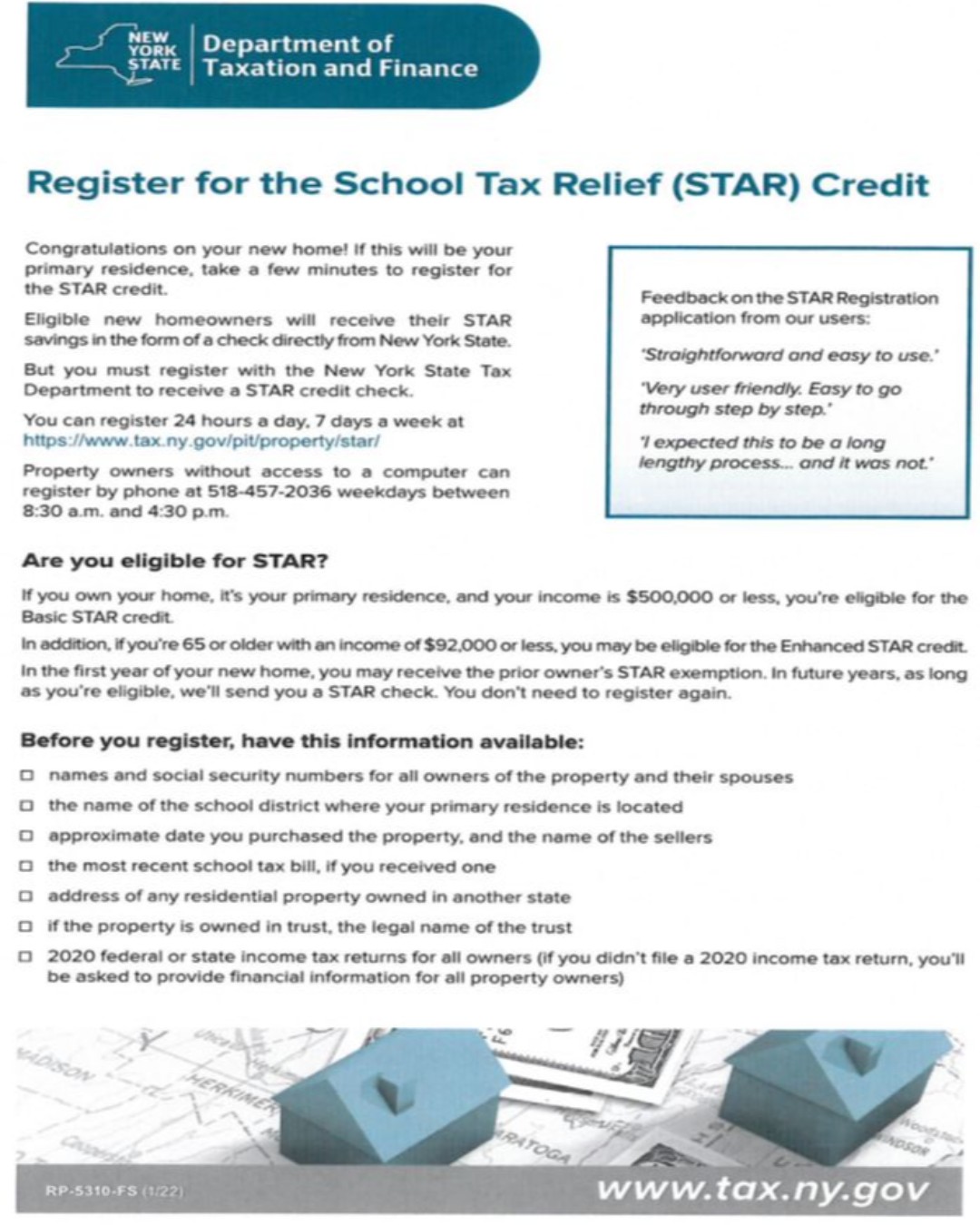

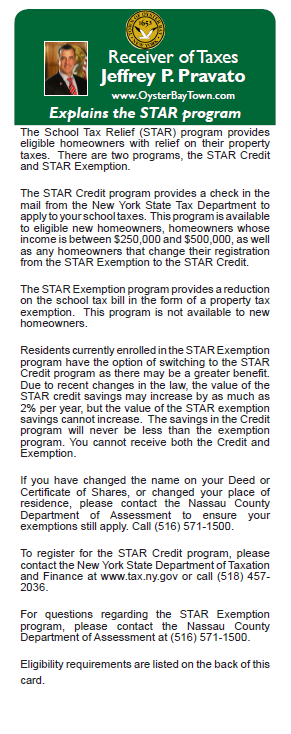

To be eligible for Basic STAR your income must be 250000 or less.

. You currently receive Basic STAR and would like to apply for Enhanced STAR. 2023-24 Enhanced STAR Property Tax Exemption Application For use by homeowners already in the STAR Program prior to January 2 2015 PDF File -- 2 Pages 85 x 11 Letter Size Paper. The following security code is necessary to prevent.

You only need to register once and the Tax. This requirement applies to property owners who received Basic STAR benefits and are applying for Enhanced STAR and those already receiving Enhanced STAR benefits but who did not. To qualify for the.

Eligibility is based on the combined incomes of all the owners and any. Enhanced STAR is available to owners of condos houses and. This requirement applies to property owners who received Basic STAR benefits and are applying for Enhanced STAR and those already receiving Enhanced STAR benefits but who did not.

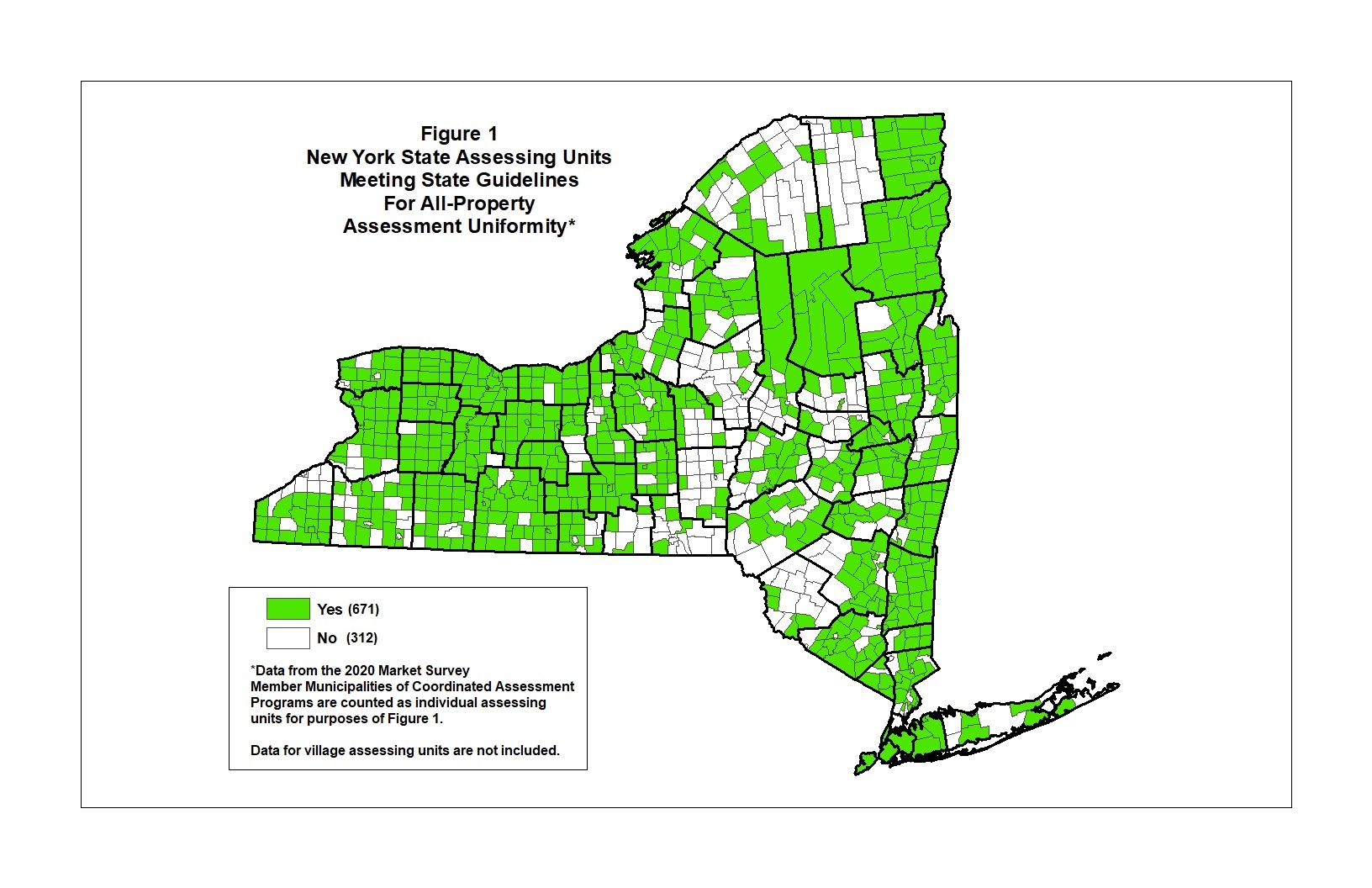

The process to apply for a STAREnhanced STAR EXEMPTION has opened. STAR helps lower property taxes for eligible homeowners who live in New York State school districts. Register for the Basic and Enhanced STAR credits.

The following security code is necessary to. To be eligible for Enhanced STAR you must have earned no more than 86000 in the 2016 tax year. All applications are due by March 1 2023 for the 202324 December 2023 - November 2024 Tax Year.

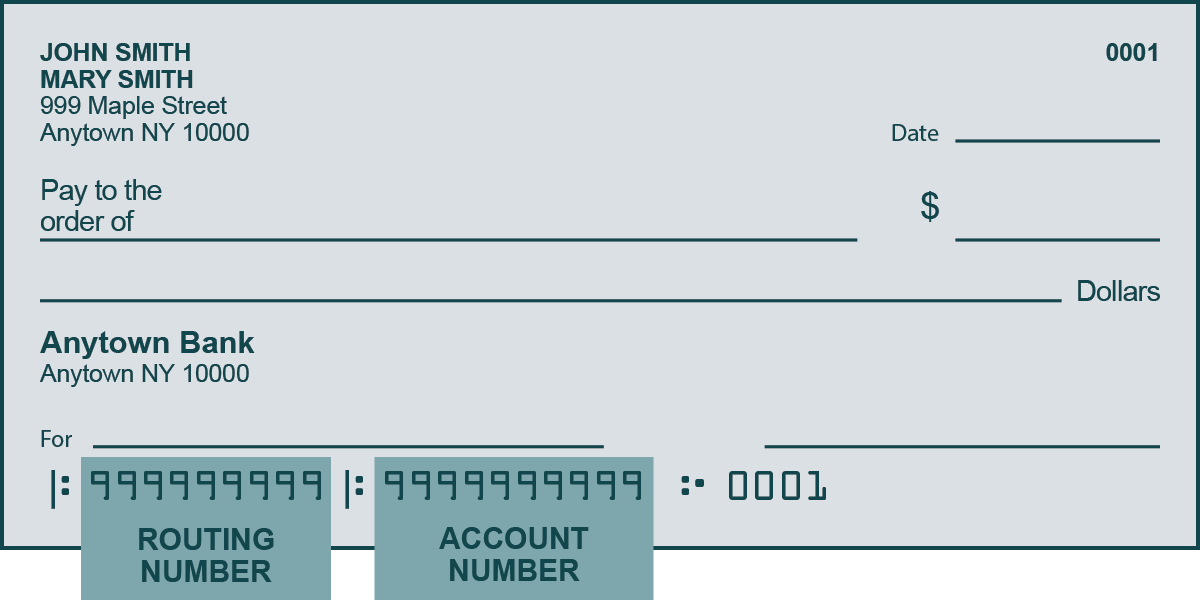

STAR Check Delivery Schedule. Basic STAR is for homeowners whose total household income is 500000 or less. If your STAR check hasnt shown up and your due date to pay your school property taxes has passed contact the Department of Taxation and Finance through your Online.

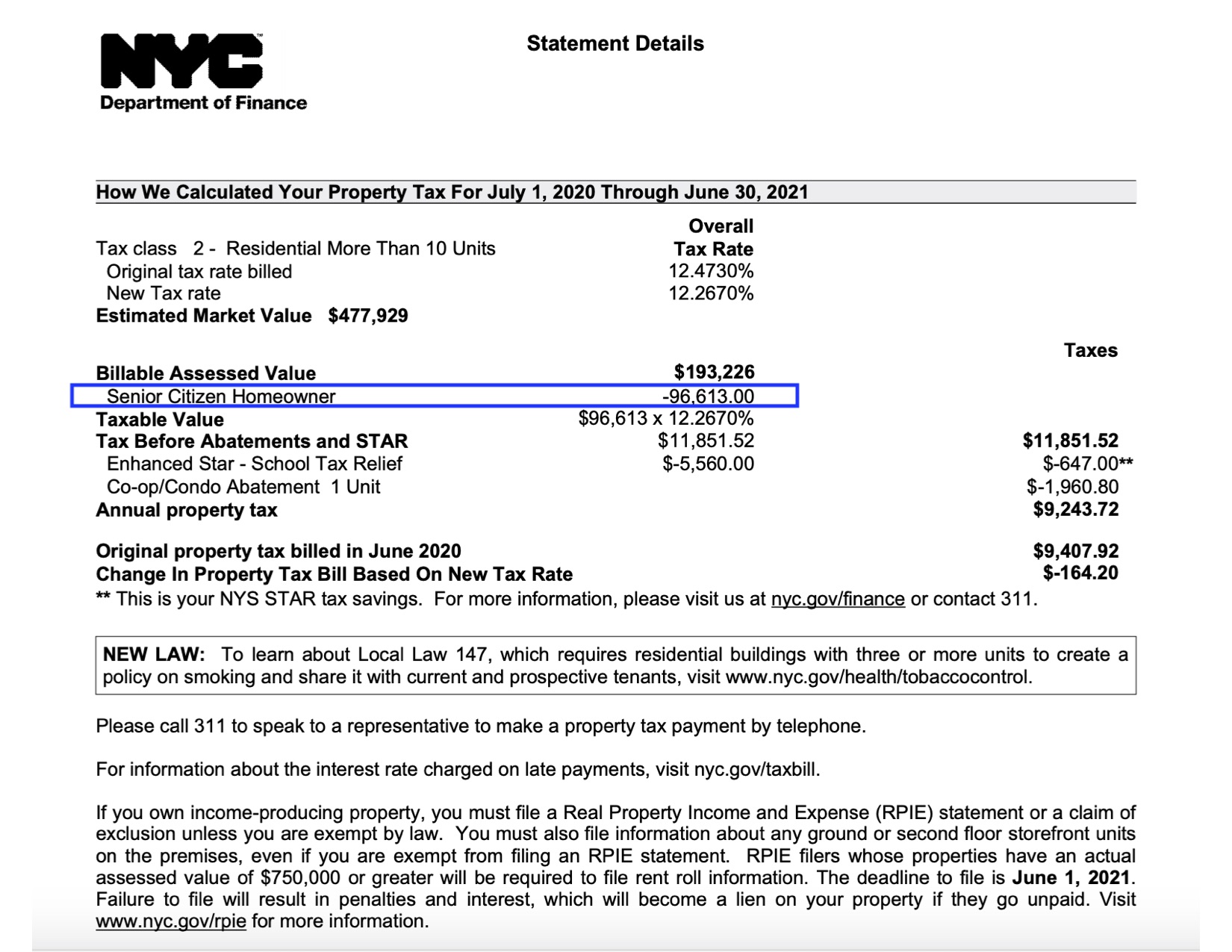

Qualified recipients of the Enhanced STAR exemption save approximately 650 in NYC property taxes each year. Enter the security code displayed below and then select Continue. You may be eligible for Enhanced STAR if.

The Enhanced STAR application is for owners who were in receipt of the STAR exemption on their property as of the 2015-16 tax year and wish to apply for Enhanced STAR.

New Requirements For The Enhanced Star Exemption In Nys Weny News

Did You Get Your Tax Rebate Check Yet Here S How Many Haven T Gone Out

What Is The Basic Star Property Tax Credit In Nyc Hauseit

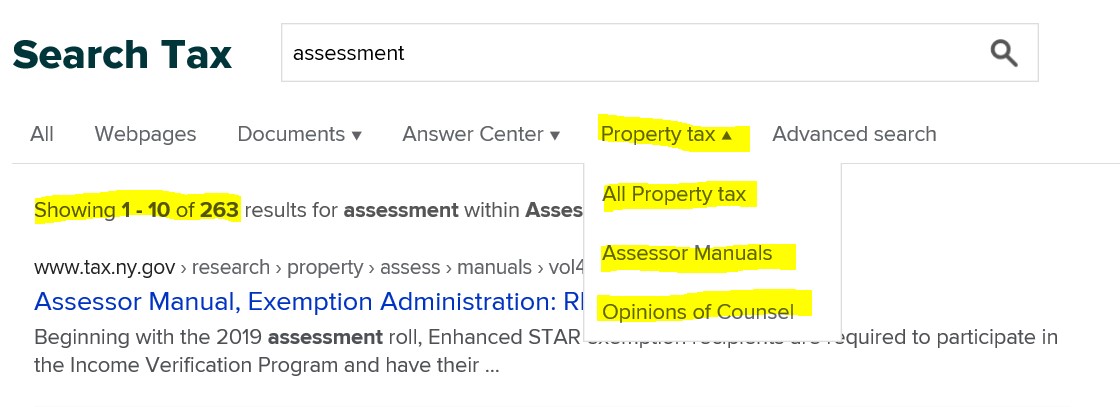

04 19 2021 Assessment Community Weekly

New York Property Owners Getting Rebate Checks Months Early

Receive Your New York State Tax Refund Up To Two Weeks Sooner

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul Yonkers Times

Department Of Taxation And Finance

Ny S Star Benefit Checks Are Arriving Did You Get Yours

Additional New York State Child And Earned Income Tax Payments

Tax Collector Tax Assessor Town Of Lewis Ny

Register For The School Tax Relief Star Credit By July 1st Greene Government

Town Of Salina On Twitter Register For Basic Star Credit If Property Is Your Primary Residence Amp Income Is 500 000 Or Less Https T Co Svry6rjmdn Or By Phone Weekdays 8 30am 4 30pm 518 457 2036

Tax Exemptions Town Of Oyster Bay

Deadline Coming Up For Seniors To Apply For Enhanced Star Exemption Wham

02 16 2021 Assessment Community Weekly

If You Cheat The Star Program In Ny You Could Lose The Tax Breaks